Invest Like A Tortoise

When we think about wealth, we often remember stories of near-overnight successes. Those who picked the right stock, or sold the best NFT, or won the lottery. These stories get a lot of airtime and word-of-mouth tends to spread them like wildfire, so it’s only natural to want to be a part of the trend. But how often do these trends not work out?

The volatility of the stock market over the past few years has been quite jarring due to outside forces like the pandemic, political events, and trade sanctions. The NFT and cryptocurrency markets have also experienced substantial losses. This means that many individuals have lost a lot of money trying to bet on the right “stock” horse or by jumping on NFT/crypto trends. Does this mean you should never buy individual stock or put money into a promising new financial trend? Not necessarily!

The key to building the wealth and the financial stability you dream of lies in the information you have. When wanting to invest your money in the short-term, you should always be asking yourself:

“What information do I have that the rest of the market may not?”

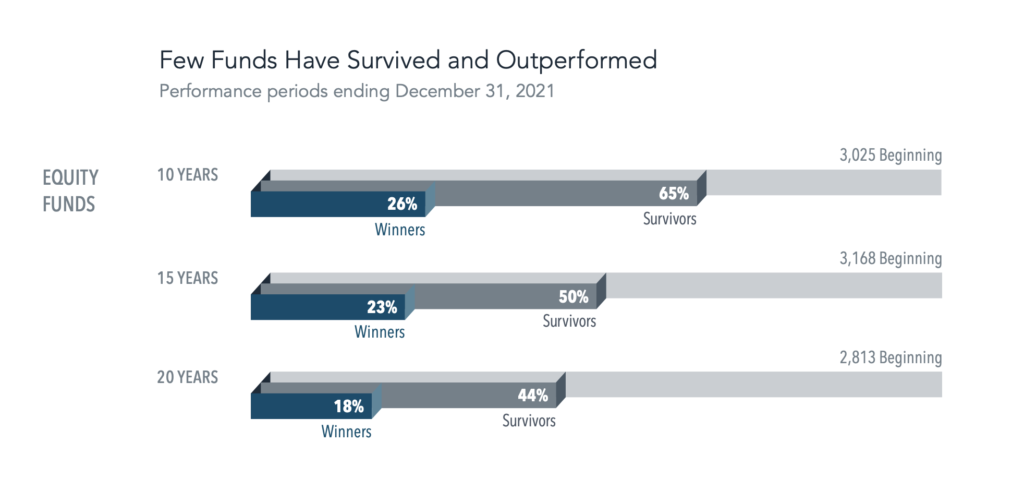

If you don’t have a strong answer to that question, it might be time to rethink the investment. Historically, studies have shown that the stock market is quite good at regulating itself and pricing stocks appropriately. This is because information travels quickly, and prices adjust accordingly. The price of a stock doesn’t always reflect its actual value, but it’s a low probability that you can consistently pick the mispriced ones. In fact, over the past 20 years, 56% of equity mutual funds were closed due to poor performance. Of the surviving funds, only 18% were able to outperform the market.

If all you have is a feeling that the stock will go up and no concrete information indicating that it will you may want to do some more research before making your decision.

Again, it’s natural to want to be a part of these financial trends. As humans, we crave connection and being a part of something with others; and we sure hate missing the boat. But building real wealth takes time! If you’re properly saving and living within your means, you’re less likely to even need or crave the big gains that happen now and then on the stock market. Take Warren Buffet, for example, he amassed 90% of his wealth after the age of 65. His belief in “getting rich slow” helped him through all of the market crashes and financial instability that the stock market has experienced in the last few decades.

While putting your money away into a long-term investment with only a 5-7% return may not seem too exciting, the results at the finish line often astound our clients. So, invest like a tortoise so you don’t lose your hair.

The information in this document has been prepared by TCM Financial Studio, a registered investment advisor with PEAK Securities Inc. The information has been obtained from sources considered reliable and relevant. The information in this document is general in nature and may not be complete in regards to your personal situation. This document does not constitute investment advice. The opinions expressed above do not necessarily reflect those of PEAK Securities Inc. Peak Securities is not liable for the content of this document.