Response to Ben & Michelle

Ben & Michelle Question 1: How much should we be spending/ saving each month?

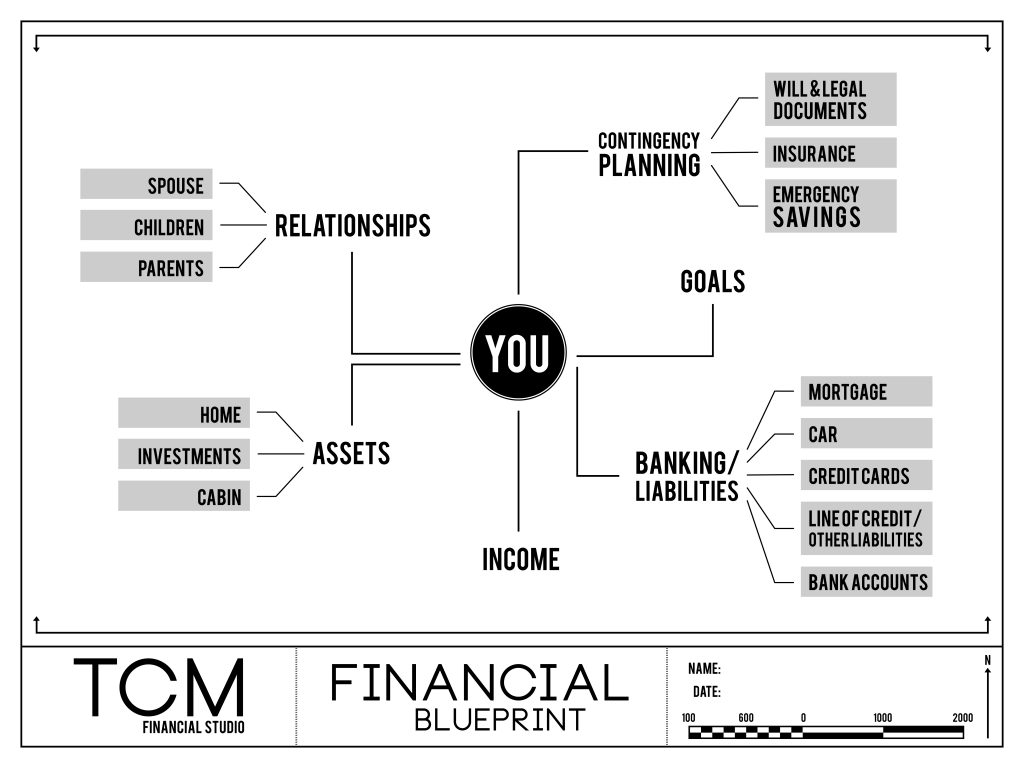

This is the most popular question that we are asked from new and existing clients. The goal of TCM’s process is to find a balance between current spending and future spending. The financial projections that we complete for clients provide the most accurate response to this question. Each financial plan will differ from case to case since the results depend on the client financial situation and goals. However, I have provided an example of a financial plan for a fictional client to help you understand the information we gather and what the results look like once the projection is complete.

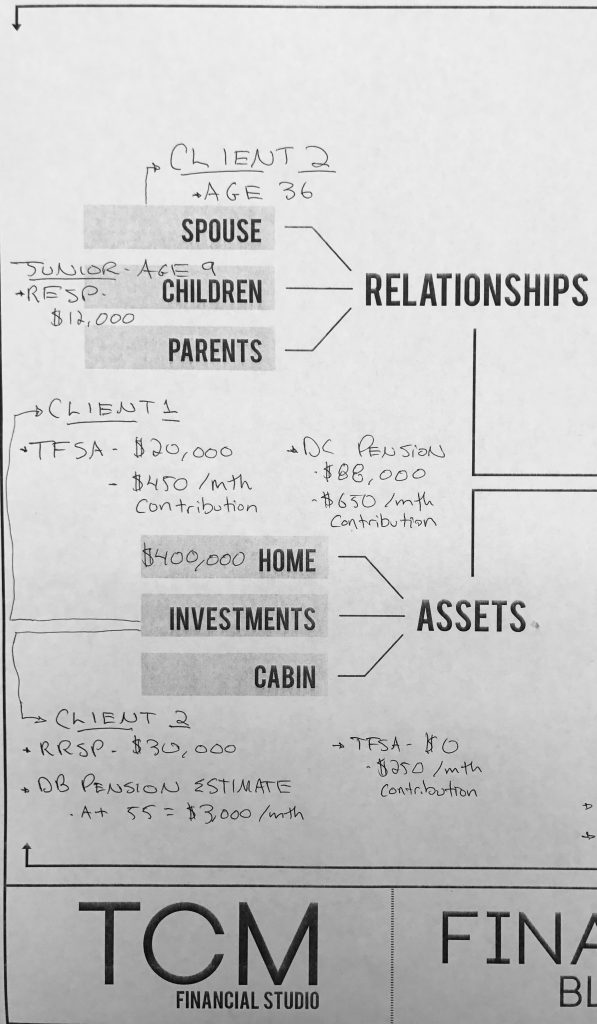

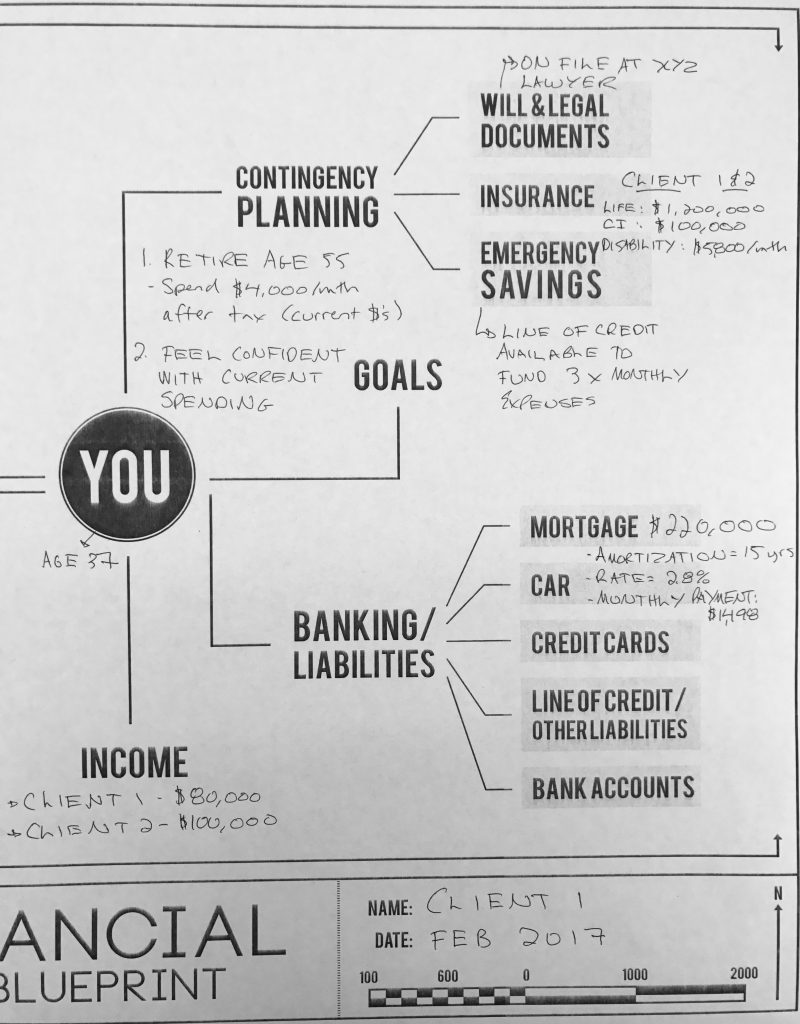

FICTIONAL CLIENT: Client 1 & 2

The client situation – Client 1 and 2 would like to retire at age 55 and spend $4,000 per month (after tax and in current dollars). Here is their financial blueprint (please scroll to the appendix of this post for a text version of the client situation and projection assumptions):

Results of the financial projection – The clients are projected to have the capacity to spend $3,840/ month during their retirement years if they continue on their current pace of spending and saving. If the clients were not satisfied with the results, we would look at developing a plan to meet their $4,000/ month retirement spending goal. Here are a few options:

-

- Save an additional $209/ month until retirement

- Increase the risk of their investments with hopes of earning a better return

- Retire at age 56 instead of age 55

Ben & Michelle Question 2: How should we allocate our investment dollars within our portfolios?

We match each goal of the client to a short, medium and long-term portfolio. The holdings of each portfolio will differ slightly for each client based on their risk tolerance. Our job is to present a few different options for each goal and help the client feel comfortable with the investment portfolio that is being implemented.

Appendix – Client 1 & 2 – Details & Assumptions