RE: David Alport Question

David: How do I plan to provide for my family while still doing the things I love or be able to do the things I love when I can no longer work?

David, thanks for being a client hero! The personal finance section of the newspaper often discusses how people are spending too much money and taking on too much debt. What is usually not considered is the fact that some people save too much and there are consequences of these actions as well. The trick is finding the balance between spending money to support your current ideal lifestyle while taking responsibility for your long term goals.

When we first meet with new clients they are usually focused on one area of their financial life that is bothering them. They tend to want to check specific things off their financial list before exploring items on their bucket list. It is common to see the client at this point showing signs of uneasiness. What is interesting to witness is the change in mindset of new clients after running financial projections and developing long term strategies for all areas of their financial life. These clients have typically never been shown how their current actions will affect them in the future. Nor have they looked at their financial life through a comprehensive lens.

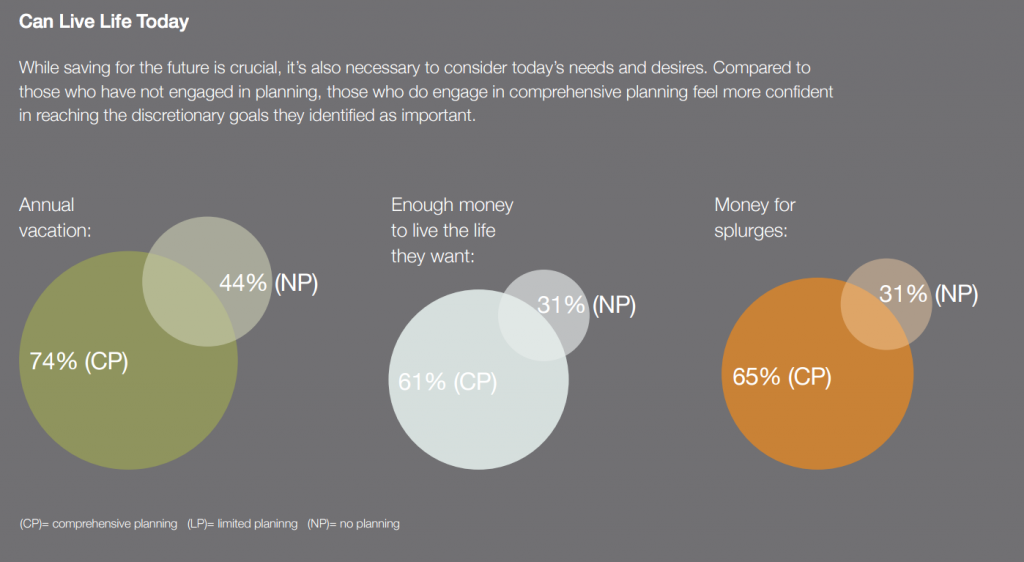

Our clients have told us that they feel empowered after completing a comprehensive financial plan. A study on the value of financial planning completed by the Financial Planning Standards Council confirms some of these feelings our clients have voiced to us. Here are the results on the topic of living life for today rather than delaying it for the future. It compares those people who have comprehensive financial plans and those who do not.

In summation, optimizing your enjoyment of life in the short term and long term can be achieved by completing a comprehensive financial plan with a qualified professional. Of course the plan will rely on you taking the responsibility for implementing the agreed-upon strategies over time. Periodic reviews of your financial plan with your financial planner will help ensure that you remain on track, finding balance in all areas of your life. It is one of the most valuable lessons that John (Dad) has taught Connor and I. It is something that can be worked towards, but never mastered!

David, we hope this post has not overwhelmed you. If it did, please take comfort in knowing that we are going to be with you every step of the way as you transition from a student to a practicing dentist and beyond.

-Taylor

Full FPSC study: CLICK HERE